philadelphia wage tax work from home

Come to work at the Philadelphia work location on a given day and the remaining 80 must work from home. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work.

Portrait Of A Woman Warehouse Worker Or Supervisor

Residents living in the suburbs are subject to this lower rate EIT where they live- unless.

. Consistent with the Citys current guidance for office workers that remote work must. You must speak to your employer about changing your tax status. SIT rates for residents have been increased to 38712 percent for the calendar year 2019.

Non-resident wage tax still applies if working from home By Jeff Horvath Apr 18 2020 Updated Jun 18 2020 0 Followers For those who commute to Philadelphia for a job working from home during. Telecommuters however may no longer be subject to the Philadelphia Wage Tax when they work from home. Employees file for a refund after the end of the tax.

Residents living in the suburbs are subject to this lower rate EIT where they live-unless they work in. Philadelphia nonresident employees are not subject to the citys wage tax for at-home work Residents are subject to the tax regardless of where they work Nonresident employees who usually work in Philadelphia but are required by employers to work outside the city including from home are not subject to the wage tax for time spent working elsewhere. The wages of the non-resident employees who are required to and do work at home are not subject to Wage Tax except on the days they report to the Philadelphia work location.

Under this standard a non-resident employee is exempt from the Wage Tax when the employer requires him or her to perform a job outside of Philadelphia including working from home. Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with a Wage Tax refund petition in 2021. What is Philadelphia city wage tax 2019.

Anyone who works in Philadelphia and lives elsewhere must pay the non-resident Philadelphia Wage Tax which is 35019 of gross wages. Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 35019 of gross wages. The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non-residents respectively.

2020 COVID EZ Wage Tax refund petition non-residents only PDF. In the state of California the new Wage Tax rate is 38398 percent. The new rates are as follows.

So you might think non-residents who worked from home during the. Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross wages. The letter which must be on.

Workers can change their tax status and be exempt from the City of Philadelphias City Wage Tax of 34481 until June 30 2020 and 35019 beginning July 1 2020. What is PA wage tax. Those FAQs clarified that when workers work from home because of an employer policy that materially limits their ability to come into the office nonresident employees are only subject to Wage Tax.

Wage tax collections in the current fiscal year will be about 200 million less than initially projected. When the wage tax applies to Philadelphia nonresident employees. Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online Wage Tax refund petition in 2021.

Middletown Township levies an Earned Income Tax EIT of only 05. Philadelphia has already lost hundreds of millions of dollars in tax revenue since the coronavirus swept the country. Nearly all municipalities in the Philadelphia area levy an Earned Income Tax EIT with most topping out at 1.

A portion of that loss could become permanent if companies keep employees home indefinitely. From March 16 2020 through July 3 2020 while the stay-at-home order was in place and until Philadelphia entered the modified green phase of reopening an employer has a policy that no employee may work from. The responsibility for proper tax reporting falls on the individual employee.

If you dont need to pay the Philadelphia Wage Tax you are subject to the Earned Income Tax. Non-resident salaried employees can use this form to apply for a refund on 2020 Wage Tax for days they were required to work from home by their employer because of the coronavirus pandemic. Requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

Normally Philadelphia non-residents employed in the city can get a wage tax refund for days they worked outside of Philadelphia. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. What is the city Wage Tax in Philadelphia.

Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization. Employees will need to provide a copy of their W-2 form and a letter from their employer stating they were required to work from home. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

The following FAQs address when the Wage Tax applies based on an employers work-from-home policy.

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

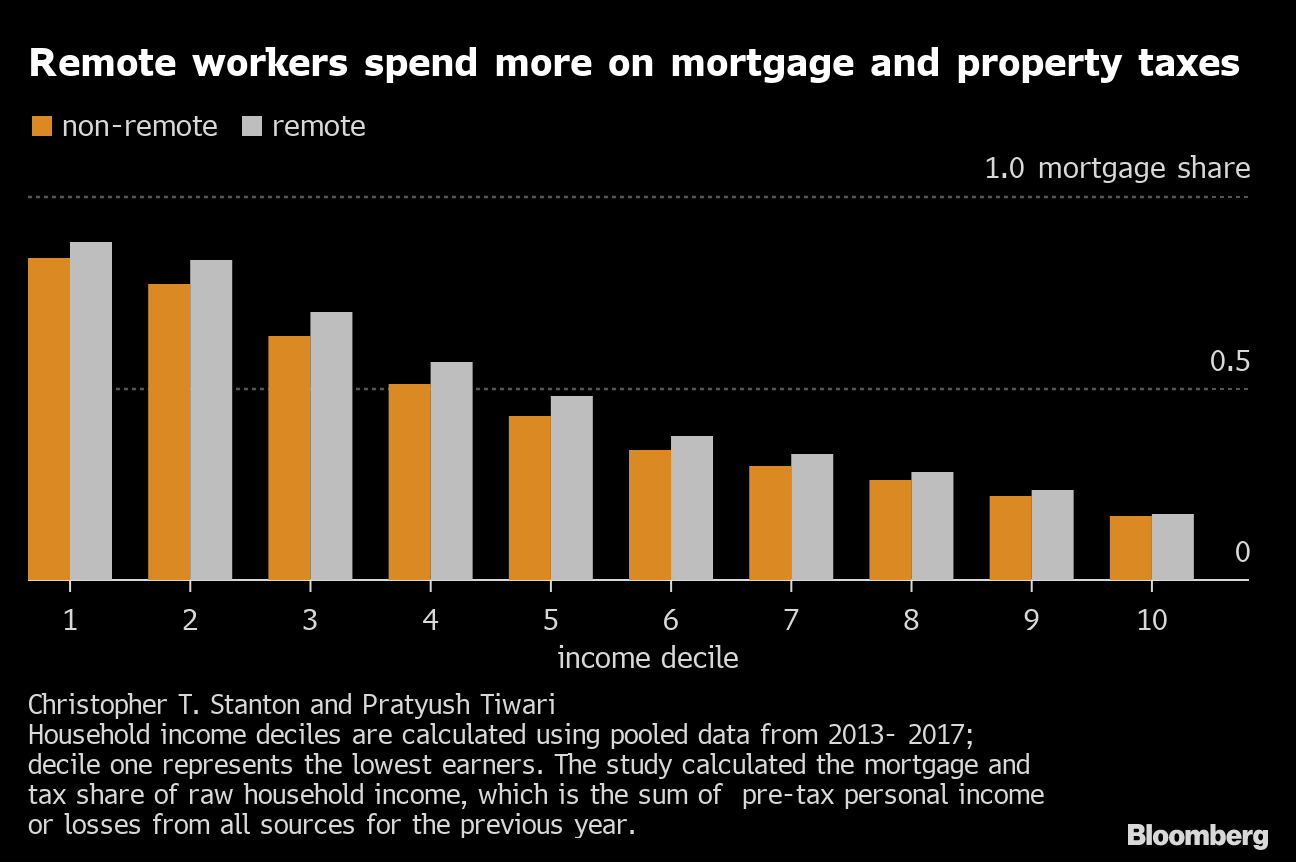

Why Remote Workers Spend More On Housing And Rent Bloomberg

Flat Rate Home Office Work From Home Deduction For 2021 And 2022 R Personalfinancecanada

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

The Most And Least Tax Friendly Major Cities In America

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

First Time Home Buyers Inventory Expected To Rebound In 2024

The 10 Most Affordable States In America States In America Map Best Places To Retire

Remote Alternative Work Arrangements Strategies For Success And Reducing Risk New Jersey Law Blog

Tax Rates And Income Brackets For 2020

Will States Come Together To Resolve Remote Work Tax Withholding Issues Or Will We Continue Waiting Here On The Long And Winding Road Employment Law Spotlight

Why Remote Workers Spend More On Housing And Rent Bloomberg

Suburban Workers Reprieve From City Wage Tax Is Ending

Greater Sudbury Chamber Of Commerce Home Facebook

Work From Home Tech Companies Cut Pay Of Workers Moving Out Of Big Cities Bloomberg

Now Hiring Huge List Of Work At Home Jobs For Reliable Income